New book: The Clash of the Cultures: Investment vs. Speculation, By John C. Bogle ’51 (Wiley)

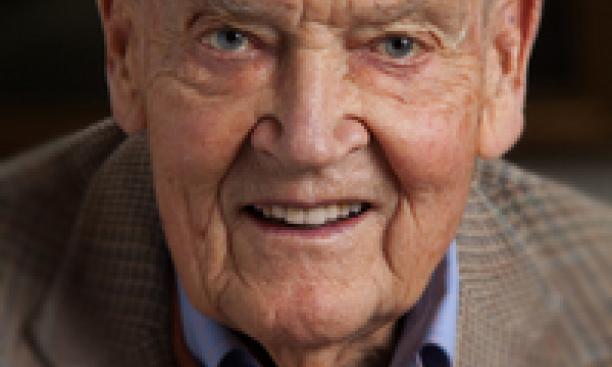

The author: The founder and former CEO of the Vanguard Group of mutual funds and creator of the first index mutual fund, Bogle is president of Bogle Financial Markets Research Center. In 1999 Fortune magazine named him one of the four “investment giants” of the 20th century, and in 2004 Time magazine named him one of “the world’s 100 most powerful and influential people.”

The book: After 60 years in the financial field, the author sounds an alarm on what he sees as the change in culture from a focus on long-term investment in financial markets to a culture of short-term speculation — which, he argues, benefits financial sector insiders at the expense of their clients. He looks at the mutual fund industry, proposes the establishment of a “federal standard of fiduciary duty that places the interests of fund shareholders first,” and recommends fixes to America’s retirement system. Bogle concludes his book with 10 rules for successful investing.

Opening lines: “In 1951, when I began my career, long-term investing was the mantra of the investment community. In 1974, when I founded Vanguard, that tenet still remained intact. But over the past several decades, the very nature of our nation’s financial sector has changed — not for the better. … Today’s model of capitalism has gotten out of balance, to the detriment of the investing public — indeed, to the ultimate detriment of our society.”

Reviews: Forbes magazine called the book “a must read for investors who want to understand the forces that are working against them and what they can do about it to maximize their investment returns. It should come as no surprise to those who know Jack and his philosophy that the final words of his final book are: ‘Stay the course!’” The Clash of the Cultures, wrote The Economist, “echoes many familiar . . . themes worth repeating, because they are too often ignored. Investors spend so much time chasing hot asset classes and hot fund managers that they end up buying high and selling low, all the while incurring transaction costs.”

Read more: PAW’s interview with Bogle in the March 7, 2012, issue.